Broke No More: Ultimate Budgeting Hacks for Students

Nearly 15% of full-time domestic undergraduate students in Australia often skip meals to save money. Also, 58% of students worry a lot about their finances. With rising costs, many students struggle to afford basic needs.

University in Australia is still subsidized but more expensive than before. The cost of living, textbooks, and laptops adds up. International students face even more challenges with higher fees and moving costs.

Many students work part-time to make ends meet, but it's not enough. They often work too much, sacrificing their studies. But, with the right budgeting tips, you can manage your finances well and succeed in university.

Key Takeaways

Understand your income and expenses to create an effective budget

Take advantage of student discounts to save on everyday expenses

Meal plan and cook at home to cut down on food costs

Explore campus clubs and organizations for affordable entertainment

Seek out financial assistance and part-time work to supplement your income

Create a Budget

Creating a budget is the first step to managing your money as a student. It helps you understand your financial situation. This way, you can work towards your savings goals.

Determine Your Income and Expenses

Start by figuring out your monthly income from different sources. This includes wages, government benefits, or investments. Then, list your regular expenses like rent, utilities, and transportation.

Also, include variable expenses such as groceries, entertainment, and personal care. This will give you a clear picture of your spending.

With this information, you can find ways to save money. You can then use that money for your savings.

Set a Savings Goal

Setting a savings goal is key to financial planning. Decide how much you can save each month. Aim for a specific target, like building an emergency fund or saving for a big purchase.

Automate your savings by setting up regular transfers to a savings account. This makes saving a regular habit.

Remember, your budget can change. Update it when your income, expenses, or financial goals change. A good budget helps you avoid debt, track your spending, and use your student resources wisely.

Take Advantage of Student Discounts

As a university student, you get to enjoy many discounts. These can save you money on tech, entertainment, and more. By using these student discounts, you can have fun without breaking the bank.

First, check out websites like UNiDAYS and StudentVIP. They list lots of discounts on tech, health, and study stuff. Brands like Adobe and Microsoft even give students free or cheap access to their products.

Also, see if your university has travel discounts. These can make public transport cheaper. Plus, many local spots offer student deals. Just ask when you buy or book something.

Explore student discount websites like UNiDAYS and StudentVIP

Take advantage of free or discounted access to software and applications

Look for travel concessions and local business discounts

By looking into these student discounts, you can save a lot. And you'll get to enjoy more affordable entertainment while at university.

Cook at Home

Are those UberEATS orders adding up? Cooking at home is a smart move. It's cheaper and healthier. Here are some tips to help you save money without losing flavor or nutrition.

Meal Planning and Grocery Shopping Tips

Make a shopping list before you go to the store. This stops impulse buys and makes sure you get what you need.

Buy in bulk when you can. Getting more produce, grains, and pantry items at once can cut costs.

Prep meals ahead of time. Portion out meals and freeze them. This is great for busy times when cooking is hard.

Shop when you're not hungry. Shopping on a full stomach helps you avoid buying too much.

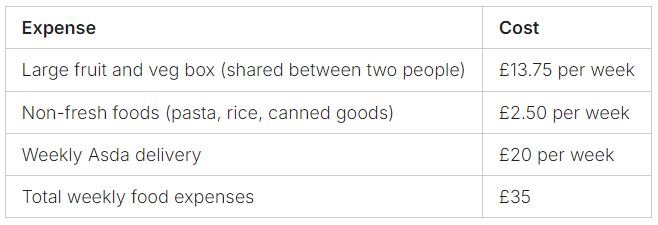

Cooking meals at home for £1.50 or less can save you a lot. You'll spend less on lunches and dinners than eating out. This could save you over £2,000 a year!

"Cooking at home is not only cheaper, but it also allows me to control the ingredients and customize the dishes to my taste. It's a great way to save money and stay healthy."

Budgeting Tips for Students

As a student, budgeting might seem hard, but it's key for your financial health. Making a budget helps you control spending, avoid debt, and reach your financial goals.

First, figure out your income and essential expenses. This includes scholarships, jobs, and family help. Also, remember fixed costs like rent and utilities. After knowing your finances, you can plan for fun, savings, and emergencies.

Use budgeting tools and apps to keep track of your spending. Checking your bank statements often helps spot wrong charges. The MoneySmart website, made by the Federal Government, offers free advice to manage your budget well.

Find ways to save, like cutting grocery bills or canceling subscriptions. This frees up money for savings or other goals. Budgeting is a continuous process. You need to update your budget as your finances or goals change.

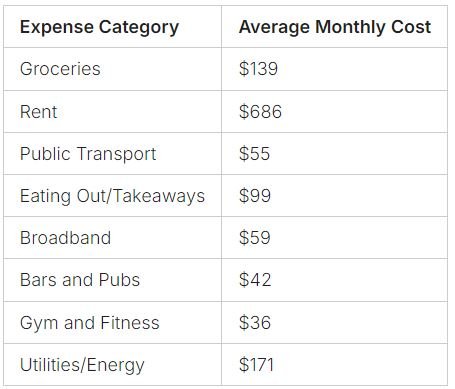

A $20 cut in weekly grocery bills can save over $1,000 a year. This can fund leisure activities or investments.

Stay on budget by setting financial goals and tracking your spending. Plan your weekly expenses ahead. With effort and a smart plan, you can create a budget that supports your studies and personal dreams.

Join Campus Clubs and Organizations

Want to have fun without spending a lot? Joining a university club or society is a great idea. All you need to do is sign up for a free USU membership during Welcome Week or anytime online.

The USU Access Rewards program gives you a 10% discount on food and retail across campus for $45. You can also enjoy the $6 After 6pm program at Abercrombie Café or Coffee @ Fisher. This offers discounted meals for late-night classes or study sessions. Plus, USU Rewards members get a free meal on every 7th purchase.

Looking for an even better deal? Check out the Bring Me Home partnership with the USU. It offers up to 70% off retail prices on end-of-the-day specials at USU outlets. It's good for your wallet and the environment!

There's a club or society for every interest, whether it's sports, arts, or community service. Joining a cheerleading society, for example, is a great way to meet new people and stay active. Just remember to buy your club tickets in advance to save money.

Seek Financial Assistance

Being a student can be tough financially, but help is out there. The Australian government's MoneySmart website has lots of advice for students. If you need extra money, your university's Financial Support Service can help.

Universities offer grants, scholarships, and loans to support students. You might get hardship funds, bursaries for tough times, or scholarships for good grades. These tools can help you reach your goals without getting into debt.

Government Resources and University Support

The Australian government has many resources for students. MoneySmart gives tips on budgeting, student discounts, and more. Your university's Financial Support Service can also help you find grants, scholarships, and loans.

Explore government financial resources like the MoneySmart website

Reach out to your university's Financial Support Service for assistance

Inquire about grants, scholarships, and loan programs available to students

Utilize financial planning tools to help you manage your income and expenses

Seek support if you're struggling with debt or financial hardship

Using these resources can make student life easier financially. You're not alone in this. There's help to reach your goals and avoid debt.

Work Part-Time

As a student in Sydney, looking into part-time work is a smart move. It helps you earn extra money and steer clear of debt. About 80% of Australian undergraduate students work part-time, with 31% working over 20 hours a week.

The hospitality and retail sectors are favorites among students. They offer flexible hours and don't require a degree. This makes it easy to find friends while earning money.

But, be careful not to overdo it. Your part-time job should not get in the way of your studies. Finding the right balance is crucial to succeed in both work and school.

"Only take on what you can cope with - you don't want your unskilled side hustle to be getting in the way of your studies, the whole reason you're working in the first place."

Conclusion

Learning to budget as a student might seem hard, but it's doable. With the right strategies and determination, you can beat financial challenges and gain freedom during college. By making a detailed budget, using student discounts, cooking at home, and finding ways to save, you can manage your money well.

Tracking your spending is crucial to find where you can save more. Use budgeting apps and online tools to keep track of your money. Also, don't hesitate to ask for help from friends, university resources, and financial experts. With smart spending and a resourceful attitude, you can avoid being seen as a "broke student" and secure your financial future.

By using the budgeting tips from this article, you can control your finances, reduce stress, and focus on your studies and personal goals. Take on the challenge and start your journey to financial empowerment. A rewarding college experience is waiting for you.

FAQ

How can I create a budget?

First, figure out how much money you make and spend. Then, decide how much you want to save. This helps you see where you can spend less.

What types of student discounts are available?

Students can get discounts on tech, health, food, books, and travel. Look for deals on student websites and programs.

How can I save money on meals?

Save by cooking at home. Plan your meals and make a shopping list. Buying in bulk and not shopping when hungry can also help.

What are some budgeting tips for students?

Stay organized and avoid extra fees. Use tools to track your spending. If you need help, ask a financial advisor.

How can I find affordable entertainment?

Join university clubs and societies. They often have free or cheap events and activities.

What financial assistance options are available for students?

Look into government and university aid. This includes grants, scholarships, and loans to help with costs.

Should I get a part-time job?

Getting a part-time job can earn you extra money. But, make sure it doesn't interfere with your studies.